FORM 3B – DIRECTOR/CHIEF EXECUTIVE NOTICE

NOTIFICATION OF INTERESTS IN SHARES OF ASSOCIATED

CORPORATION OF

A LISTED CORPORATION

General Notes

1.

This

Form 3B is for use by a

director or chief

executive disclosing an interest

in shares of an associated corporation of a Hong Kong listed corporation of which he/she is a director or chief executive under Part XV of the Securities and Futures Ordinance (Cap.571) (“SFO”).

You must complete the notice

in accordance with the directions and instructions

in these Notes and then file the notice with The Stock Exchange of Hong Kong

Limited (“SEHK”).

2.

Use :

Form 1 if you

are an individual with an interest of 5% or more of the voting shares of a

listed corporation making a disclosure (and are not a director or chief

executive of the listed corporation).

Form 2 if you

are a corporation with an interest of 5% or more of the voting shares of a

listed corporation making a disclosure.

Form 3A if you are

notifying interests in shares of the listed corporation of which you are a

director or chief executive.

Form 3C if you are

notifying interests in debentures of the listed corporation of which you are a

director or chief executive.

Form 3D if you are

notifying interests in debentures of any associated corporation of the listed

corporation of which you are a director or chief executive.

Form 4 if you

are a listed corporation that is required by section 330(1) or 333(1) of the

SFO to notify the SEHK of information received in pursuance of a requirement

imposed by the listed corporation under section 329 of the SFO, or to deliver a report prepared under section 332

of the SFO to the SEHK.

Please use separate forms to disclose your interests

if you are interested

in (i) more than one class of shares or debentures

of a listed corporation of which you are a director or chief executive, or an associated corporation of that listed corporation; or (ii) shares or debentures of more

than one associated corporation of a listed corporation of which you are a

director or chief executive. Chinese versions

of these forms are also available.

Meaning of

“you”, “shares”, “listed corporation” and

“associated corporation” in Form 3B and these Notes

3.

In

Form 3B and these Notes the word “you” refers to the person that is the director or chief executive.

The term “shares” describes

interests in the shares of an associated corporation of the listed corporation of which you are a

director or a chief executive. The term

“listed corporation” refers to the listed corporation of which you are a

director or chief executive.

4.

An “associated corporation” is –

(i)

a subsidiary, or holding company, of the listed corporation;

(ii)

a subsidiary of the listed corporation’s holding company (e.g. a fellow subsidiary); or

(iii)

a corporation in which the listed corporation holds 20% or more of the issued shares of any class of its share capital.

“Relevant event” and “Initial

Notification”

5.

You must give notification of interests in shares of an associated corporation of a listed corporation,

and any

“short position” (explained in General Note 13 below) on the occurrence of certain events - called “relevant events” (see section 308 of the SFO). If you are a director or chief executive of a listed corporation, relevant events include :

(i)

When you become interested in the shares of any associated corporation

of the listed corporation.

(ii)

When you cease to be interested in such shares.

(iii)

When you enter into a contract to sell any such shares.

(iv)

When an associated corporation grants

you a right to subscribe for shares

in the associated corporation, or you exercise or assign such rights.

(v)

When the nature of your interest

in such shares changes (e.g. on exercise of an option).

(vi)

When you come to have, or cease to have, a short position in the shares of

an associated corporation.

(vii)

If you have an interest, or if you have a short position, in shares of an associated corporation of a listed corporation at the time when the listed corporation becomes a listed corporation.

(viii)

If you have an interest, or if you have a short position, in shares of an associated

corporation when you become a director or chief executive of a listed corporation.

(ix)

If you have an interest, or if you have a short position, in shares of an associated corporation when it becomes an associated corporation.

A notification of relevant events (vii) to (ix) is described in Form 3B and these Notes as an “Initial Notification”.

Timing of notification

6.

In

the case of events (i) to (vi) in General Note 5, you must give the notification

within 3 business days of the day you became aware of the relevant

event. The term “business day” means a day other than a Saturday, a public holiday and a day on which a black rainstorm warning, or a gale warning, is in force. The period is calculated excluding the day that the relevant

event occurred.

7.

For an Initial Notification,

you must normally give the notification

on this Form 3B within 10 business

days after the relevant event.

However, if at that date you were not aware that you had an interest,

or a short position, then you must give the notification within 10 business days of the day you became aware that you had such an interest

or short position.

The period allowed for filing a notice runs from the time you know of the facts that constitute the event (e.g. the purchase of the shares or the delivery

of the shares), not the day that you realize

that the event gave rise to a duty of disclosure under Part XV of the SFO.

Working out the percentage level of your interest

8.

In

Boxes 31 to 32 of Form 3B you are asked to

state the percentage level of your interest in

shares of the associated corporation. To work this out you express the total number of shares in which you are interested as a percentage of the number of shares of the associated corporation, of the same class,

in issue (i.e. the number in Box 9). Round this figure to two decimal places.

9.

In

calculating the total number of shares

in which you are interested you must include all joint interests (see

Specific Note to Box 37 below), interests through equity derivatives

(see General Note 11 below) and any such interests

in shares of the same associated corporation that any of the following persons and trusts have :

(i)

Your spouse and any child of yours under the age of 18 (See Specific Notes to Box 35);

(ii)

A corporation which you control (a corporation is a “controlled corporation” if you control,

directly or indirectly, one-third or more of the voting power at general meetings of the corporation, or if the corporation or its directors are accustomed to act in accordance with your directions) (See Specific Notes to Box 36);

(iii)

A trust, if you are a trustee of the trust (other than a trust where you are a bare trustee i.e. where you have no powers

or duties except to transfer the shares according to the directions

of

the beneficial owner) (See Specific Notes to Box 38);

(iv)

A discretionary trust, if you are the “founder” of the trust (e.g. you had the trust set up or put assets into

it), and can influence how the trustee exercises his discretion (See Specific Notes to Box 38);

or

(v)

A trust of which you are a beneficiary.

10.

You must also count as your short position any short positions that the persons and trusts mentioned in

General Note 9 have. This may create a short position (if you do not have a short position

already) or increase

the size of your short position.

11.

In

calculating the level of your interest in shares you must add together both direct

and indirect interests. You must not net off long positions and short positions

but must disclose them separately.

Indirect interests

include interests in shares underlying

“equity derivatives”.

Equity

derivatives include instruments

such

as options, warrants, stock futures and are referred to in these Notes as “derivatives”. “Underlying shares” are the shares that may

be required to be delivered

to you, or by you,

under the derivatives, and include the shares used to determine the price or value of the derivatives (e.g. in the case of an issue of “European Style Cash Settled

Call Warrants

2001-2002 relating to ordinary shares of HK$10.00 each in XYZ Ltd. issued by ABC Investment

Bank” the “underlying shares” are ordinary shares of HK$10.00 each in XYZ Ltd.).

“Long positions” and “short positions”

12.

You have a “long position”

if you have an interest in shares,

including interests through

holding, writing or issuing

financial instruments (including derivatives) under which, for example :

(i)

you have a right to take the underlying shares;

(ii)

you are under an obligation to take the underlying shares;

(iii)

you have a right to receive from another person an amount if the

price of the underlying shares is above a certain level;

(iv)

you are under an obligation to pay another person an

amount if the price of the underlying shares is below a certain level; or

(v)

you have any of the rights or

obligations referred to in (i) to (iv) above embedded in a contract or

instrument.

13.

You have a “short position” if you borrow shares under a securities borrowing and lending agreement, or if you hold, write or issue financial

instruments (including derivatives)

under which, for example :

(i)

you have a right to require another person to take the underlying shares;

(ii)

you are under an obligation to deliver the underlying shares;

(iii)

you have a right to receive from another person an amount if the

price of the underlying shares is below a certain level;

(iv)

you have an obligation to pay another person an amount if

the price of the underlying shares is above a certain level; or

(v)

you have any of the rights or

obligations referred to in (i) to (iv) embedded in a contract or instrument.

14.

The number of shares in which you are taken to be

interested, or to have a short position, through derivatives is :

(i)

the number of shares that may

have to be delivered to you, or by you, on the exercise of rights under the

derivatives;

(ii)

the number of shares by

reference to which the amount payable under the derivatives is derived or

determined; or

(iii)

(in the case of stock futures

contracts) the contract multiplier times the number of contracts you hold.

If any party to a derivative

can choose whether to settle in cash or by delivery then use (i) to work out the number of shares in which you are interested. If it is not possible to determine

precisely the number of shares in which you are taken to be interested

(or have a short position) at the

date when you first acquire an interest

in the underlying shares through an equity derivative then you should

still file a notice if the number of shares in which you

are interested may exceed 5% or more of the issued shares of the listed

corporation concerned. For

example, if the number of shares that you will

receive under an equity derivative is determined by the price of the shares on

a given date in the future (and there is a minimum number that you are bound to

get) then if that minimum number (together with any other shares in which you

are interested) exceeds 5% or more of the issued shares of the listed

corporation concerned, a duty arises on entering into the derivative. If the derivative specifies only a maximum,

then disclose the maximum figure. If the

derivative specifies both a maximum and a minimum, then disclose the figure

which is most appropriate. If the derivative does not specify any minimum

or maximum, then no duty of disclosure

arises on entering into the derivative. Once the number of shares that you will receive is known a duty of disclosure arises.

General

15.

The “Outline of

Part

XV” (“Outline”) published by the Securities

and Futures Commission (“SFC”) gives further guidance on the situations in which a notice will have to be filed under Part XV. A copy of the Outline can

be downloaded from the SFC’s website http://www.sfc.hk. However, when making a disclosure you must satisfy yourself of the requirements of the SFO, and if in doubt, please seek appropriate legal advice.

Electronic filing of notices

16.

Upon the commencement of Part 4 of the Securities and

Futures (Amendment) Ordinance 2014 on 3 July 2017 (“Commencement”), you should

file this Form 3B electronically with SEHK by using the Disclosure of Interests

Online System (“DION System”) from HKEX website https://sdinotice.hkex.com.hk. Upon Commencement, other than in the

circumstances set out in paragraph 20 below, filings sent by fax, by post, by

email or delivered by hand will not be accepted and will not be in compliance

with the requirements under Part XV of the SFO.

17.

Forms are available in Adobe Portable Document format

(“PDF”) or in Microsoft Excel format. If

you are a Windows user, you may download and file a notice using either

format. If you are a Mac user, you may

only download and file a notice in PDF.

You may download a soft copy of this Form 3B (and these Notes) for

completion from HKEX website at https://sdinotice.hkex.com.hk or the SFC website http://www.sfc.hk/web/EN/rule-book/sfo-part-xv-disclosure-of-interests/di-notices.html.

If you download this Form 3B from the HKEX website, you can either download (i)

a complete blank Form without logging in the DION System; or (ii) a blank Form

prefilled with certain profile information after logging in the DION

System. You can only download a complete

blank Form from the SFC website. If you are using Excel format, you must click

"Enable Content" when opening the Excel forms - otherwise the macros

will not work. If you are using PDF, you

must click “Trust this document always” and save the changes.

18.

You are also required to separately submit this Form

3B to the listed corporation concerned but SEHK will send this Form 3B to the

listed corporation on your behalf if you complete and file this Form 3B

properly. The completed Form 3B that you

filed with SEHK will be sent to the listed corporation concerned based on the

stock code and the date of relevant event on the Form. Based on the stock code on the Form, the

system will fill in the name of the listed corporation. If you decide to state a corporation name

which is different from what is suggested by the system, there is a risk that

the system is not able to associate the corporation name with the relevant

stock code and thus fails to direct your Form to the relevant listed

corporation.

19.

Do not

send copies of share purchase agreements

and other

documents to SEHK when filing this Form 3B. Attaching a document that explains the transaction in

question does not discharge

the duty to complete the prescribed

form. Unless

otherwise stated, copies of any documents

that

are sent to SEHK will be displayed

together with this Form 3B on HKEX website http://www.hkexnews.hk/di/di.htm and be available for viewing

by the public when searching the DI pages of the HKEX website.

20.

If your duty to file a notification on Form 3B arose

before the date of Commencement, you may either (a) submit this Form 3B to SEHK

by using the DION System; or (b) submit the prescribed Form 3B available for

use immediately before the date of Commencement to SEHK by fax, by post, by

email or by hand. All filings made after

the period of 3 months from the date of Commencement should be made by using

the DION System.

Specific Notes

|

Box 1 |

State the date of the relevant event (explained in

General Note 5) which gave rise to the notice. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 2 |

In the case of events (i) to (vi) in General Note 5,

if you became aware of the relevant event on a date later than the date that

it occurred, then state the date that you became aware of the event that triggers

the reporting obligation in Box 2. For an Initial Notification, if you were not aware

that you had an interest, or a short position, at the date of the relevant

event, then state the date that you became aware that you had such an

interest in the shares of the associated corporation in Box 2. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 3 |

State the stock code of the listed corporation in

whose shares of the associated corporation you are interested. You can find the stock code on the HKEX

website. Alternatively you can get it from the corporation itself. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 4 |

Complete the name of the listed corporation of which

you are a director or chief executive. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 5 to 7 |

State the details of the associated corporation as

indicated. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 8 |

State the

class of shares in which you are interested.

Some corporations have more than one class of share capital, each with

voting rights (e.g. “A” and “H” shares).

If you have an interest in two classes of shares, complete a separate

Form 3B for each class of shares. If you select “Other”, state the class of shares in

which you are interested in Box 39. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 9 |

State the number of shares (in the class of shares in which you are interested) of the associated corporation which have

been issued at the date of the relevant event. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 10 |

Complete Box 10 if the associated corporation has a

Hong Kong business registration number. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 11 |

State the place where the associated corporation was

incorporated and give the number on the Certificate of Incorporation. Please fill in “N/A” if there is no

Certificate of Incorporation number. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 12 |

If

the associated corporation is a listed corporation, state the name of the exchange on which

it is listed. If the associated

corporation is listed on several

exchanges, give the primary listing. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Boxes 13 to 19 |

For

individual director/chief executive, state your personal details

as indicated. State your name in full as it appears

on your Hong Kong identity card

(“HKID Card”). If you have no HKID

Card, state your name

in full as it appears on your passport.

If you are a PRC resident who does not have a HKID Card or a passport,

state your name as it appears on your PRC Resident Card. For example, a director whose name appears

on his HKID Card as “Wong Ging Teng Anthony” would complete Box 13 as follows

:

Whereas a director who has no HKID Card and whose name

appears in his passport as “Anthony James Hay Wood” would complete Box 13 as

follows :

You need

not fill in Boxes 16 and 17 if you do not have a Chinese name. Equally you need not fill in Box 13 if you

do not have an English name. You must provide an email address

in Box 19. The data entered in Boxes

14, 18 and 19 (i.e. HKID Card/Passport/PRC Resident Card number, daytime

telephone number and email address) will not be available for viewing by the

public when searching the DI pages of the HKEX website. If you have no HKID Card/passport/PRC Resident Card,

select “Others” in Box 14 and provide details of your identification document

under “HKID Card/Passport/PRC Resident Card number” column in Box 14. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Boxes 20 to 27 |

For

corporate director/chief executive, state the details as indicated. State your

company name in full as it appears on the

Certificate of Incorporation. You should only complete Box 23 if you

have a Hong Kong business registration number. In Box 24 you should state the

place where you were incorporated and give the number on the Certificate of

Incorporation. Please fill in “N/A” if there is no Certificate of

Incorporation number. You must provide an email address

in Box 27. The data entered in Boxes 23 to 27 will not be

available for viewing by the public when searching the DI pages of the HKEX

website. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 28 |

If you are a listed corporation, state the name of

the exchange on which you are listed. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 29 |

If your parent company is a listed corporation,

state the name of your listed parent and the exchange on which it is listed.

If your parent company is listed on several exchanges, give the primary

listing. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 30 |

State

details of the relevant event (i.e. the event that triggers the notice). In the case of relevant event (i) to (vi)

in General Note 5 the details that you must give in Box 30 relate to the shares

bought/sold or involved at that time – not the shares which you already have. “Brief description of relevant

event” column State the

description which best describes the relevant event either by entering the

Code from Table 1 or selecting the

Code from the menu. If a person

connected with you acquired an interest in shares, their interest may be

treated as your interest (See General Note 9 above). For example, if a company that you control

acquired shares of the associated corporation, you should treat the

acquisition as your acquisition and use the appropriate Code – in this case

Code 1101. Use the “short position” row if you are filing the

notice because of a change in a short position. The normal position is that either a long

position or a short position will give rise to a duty of disclosure

(not both simultaneously). In the case of an Initial Notification in Box 30,

you must give details relate to the shares bought by you in the 4 months

immediately before the date of relevant event. See Table 1

for the Codes of Relevant Events. “Capacity in which shares were/are

held” column State the

description which best describes the capacity in which the shares were/are

held before and after the relevant event either by entering the Code from Table 2 or selecting the Code from

the menu. If you have disposed of an

interest in shares, select the Code describing the capacity in which you held

the shares immediately before the disposal and enter this Code in the “Before

relevant event” column. If you have acquired

an interest in shares, select the Code describing the capacity in which you

held the shares immediately after your acquisition and enter this Code in the

“After relevant event” column. If you

are giving a notice of a change in the nature of your interest in shares,

select the Codes describing the capacity in which you held your interest in

those shares before and after the relevant event, i.e. complete both the

“Before relevant event” and “After relevant event” columns. If you are, or were, the beneficial owner

but another Code also applies, please use the latter Code rather than 2101. Use the “short position” row if you are filing

because of a change in a short position. See Table 2

for the Codes of Capacity. “Number of shares bought/sold or involved”

column State the number of shares concerned (e.g. the

number of shares you bought that triggered the notice). For a change in the nature of an interest

(e.g. on exercise of an option), state the number of shares affected by the

change. “Currency of transaction” column Select the currency in which the price for the

interest in shares described in the “Number of shares bought/sold or

involved” column was paid or received. “On Exchange” and “Off Exchange”

columns State the

consideration per share paid or received for the interests in shares

described in the “Number of shares bought/sold or involved” column in the “On

Exchange” or “Off Exchange” columns as appropriate. An acquisition or disposal is made “On-Exchange”

when the transaction took place in the ordinary course of trading on a

recognized exchange and “Off-Exchange” covers all other transactions. For an on-exchange transaction, state the

highest price (per share) in the “Highest price per share” column and the

average price/consideration per share in the “Average price (per share)”

column. For an off-exchange

transaction, state the average price/consideration per share in the “Average

consideration (per share)” column and select a Code which best describes the

nature of the consideration you paid or received in the “Nature of

consideration” column. If no

price or consideration has been paid or received, or if the consideration is

services provided, the price or consideration should be stated as “0”. If the transaction that prompts disclosure

is a change in nature of your interest in shares (e.g. a securities borrowing

and lending transaction), a transaction in derivatives, or a change in short

position, the highest price per share and the average price per share

(average consideration per share and nature of the consideration for

off-exchange transactions) should be left blank in Box 30 but the

consideration for derivatives may have to be disclosed in Box 34. In the

case of an Initial Notification, the details that must be given in the “Average

price (per share)” or “Average consideration (per share)” columns of the

average price/consideration paid for the interest in shares described in

“Number of shares bought/sold or involved” column relate to the average

price/consideration paid by you in the 4 months immediately before the date

of relevant event. Similarly the nature of the consideration given in “Nature

of consideration” column relates to the nature of consideration paid by you

in the 4 months immediately before the date of relevant event. See Table 3 for the Codes of Nature of

Consideration. Example of how to complete Box 30 The first example demonstrates for relevant events (i) to (vi) in

General Note 5. Assume that you

already own 4,500,000 shares in an associated corporation of the listed

corporation. On 31 December 2003, you purchased (Off-Exchange) 400,000 shares for HK$800,000

and 100,000 shares for HK$210,000 (all shares to be held beneficially). The date of the relevant event to be inserted in Box 1 would be “31.12.2003” and you should

complete Box 30 in the following manner. 30.

Details of relevant event

* Due to

limited space in these Notes, the description of relevant event, capacity in

which shares were/are held and nature of consideration are not shown but will

be displayed in the Form. The second

example demonstrates for the case of Initial Notification. Assume that you are a shareholder who,

prior to 1 September 2003, already own 4,500,000 shares in an associated

corporation of the listed corporation.

On 31 December 2003 you are appointed a director of the listed

corporation. On 15 September 2003 you

had purchased (Off-Exchange) 400,000 shares in the associated corporation for

HK$800,000 and 100,000 shares for HK$210,000 (all shares held as trustee). The relevant date to be inserted in Box 1

would be “31.12.2003” and you should complete Box 30 in the following manner. 30.

Details of relevant event

*Due to

limited space in these Notes, the description of relevant event, capacity in

which shares were/are held and nature of consideration are not shown but will

be displayed in the Form. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 31 |

State the

total number of shares in the associated corporation concerned in which you

were interested, and those in which you had a short position (if any),

immediately before the relevant event in column 2. This figure includes all joint interests,

interests through equity derivatives and deemed interests (See General Note 9

above). State the percentage figure of your interest, your

short position (if any), immediately before the relevant event in column

3. General Note 8 above explains how

you calculate the percentage figure. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 32 |

State the

total number of shares in the associated corporation in which you were

interested, and those in which you had a short position (if any), immediately

after the relevant event in column 2.

This figure includes all joint interests, interests through equity

derivatives and deemed interests (See General Note 9 above). State the percentage figure of your interest, your

short position (if any), immediately after the relevant event in column

3. General Note 8 above explains how

you calculate the percentage figure. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 33 |

If the

notification is an Initial Notification, you must complete Box 33. State the

description which best describes the capacity in which you hold the shares or

short position listed in Box 32 either by entering the Code from Table 2 or selecting the Code from

the menu in column 1. If you hold some

of your interests in one capacity (e.g. as beneficial owner), and other

interests in other capacity (e.g. as trustee), then use two Codes (on

different rows) and the number of the interests in shares held in each

capacity (on different rows) in column 2. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 34 |

If this is an Initial Notification, you must give

details in relation to all the shares in which you are interested through derivatives. If this is not an Initial Notification, you must

only give details in relation to the shares involved in the relevant event. In either case, state the description which best

describes those derivatives either by entering the Code from Table 4 or selecting the Code from

the menu in column 2. If any party to a derivative can choose whether to

settle in cash or by delivery, treat that derivative as physically settled. If you

have an option, state the first date that the option can be exercised in the

“Begin of exercise period” column and the last date on which any option can

be exercised in the “End of exercise period” column. If you have another type

of derivative, state the maturity date in the “End of exercise period” column. State the

number of shares in which you derive an interest (or a short position) from

the derivatives in the “Number of shares” column. General Note 14 explains how to work this

out. If you have more than one derivative of the same category, add them

together and state the total number (in one row) in the “Number of shares”

column. If you have more than one derivative but they are in

different categories, use two or more Codes (on different rows) and state the

number of shares for each category of derivative (on different rows) in the

“Number of shares” column. See Table 4

for the Codes of Category of Derivatives.

Derivatives

granted by the associated corporation If

the derivatives have been

granted to you by the associated corporation

then you must give

details of those equity derivatives on a separate row in Box 34 if the relevant event

was : (i) the grant

of derivatives or rights under the derivatives - then you should state

the price per share paid or received, or the consideration per share given or received, for the grant of the derivatives

or

rights under the derivatives in the “Price for grant” column. (ii) the exercise

of rights under the derivatives - then you should state

the price per share paid or received, or the consideration

per

share given or received, on the

exercise of rights under the derivatives in the “Exercise price” column. (iii) the assignment of the derivatives or of rights under the derivatives - then

you should state the price per share

paid or received, or the consideration per share given or received, on the assignment of

the derivatives or rights under the derivatives in the “Price on assignment” column. If

no price was paid or received, and no consideration given

or received, then you should insert the figure “0” in the column which applies to you. If the derivatives were granted to any of the persons mentioned in General Note 9 by the associated corporation,

and the relevant event is the grant, the exercise of rights under or the assignment of those derivatives, then you must give the

details mentioned in the preceding paragraphs. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 35 |

If your spouse (or child under 18) is interested in

shares in the same associated corporation, your spouse’s interest/your child’s

interest is taken to be your interest. Details of that interest must also be

taken into account in completing Boxes 31 and 32. If this is

an Initial Notification, you must complete Box 35 if your spouse/child has

shares in the associated corporation. State the name of the spouse (or child

under 18), his/her address and the number of shares in which you are

interested through your spouse (or child under 18) in Box 35. State the details of each additional family

member who holds shares in the associated corporation. If this is

not an Initial Notification, you must only give details if your spouse (or

child under 18) was interested in the shares involved in the relevant event.

State the name of the spouse (or child under 18), his/her address and the number

of shares in which he/she was interested. If your family member also has a short position,

then the same principles apply. The data entered in column 3 (i.e. address of spouse

and/or children) will not be available for viewing by the public when searching

the DI pages of the HKEX website. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 36 |

If you are

entitled to exercise, or control the exercise of, one-third or more of the

voting power at general meetings of a corporation, or the corporation or its

directors are accustomed to act in accordance with your directions, and that

corporation is interested in shares of the associated corporation concerned,

the corporation’s interest will be taken to be your interest. Details of that

interest must also be taken into account in completing Boxes 31 and 32. If this is

an Initial Notification, you must complete Box 36 if a corporation that you

control (referred to in these Notes as a “controlled corporation”) has shares

in the associated corporation. If there is more than one corporation that you

control, then details of each controlled corporation must be stated

separately in Box 36. If this is

not an Initial Notification, you must only give details if a controlled

corporation was interested in the shares involved in the relevant event.

State the name and address of the controlled corporation and the number of

shares involved in the relevant event in which it was interested. If the controlled corporation also has a short

position, then the same principles apply. Box 36 should be completed as follows :

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

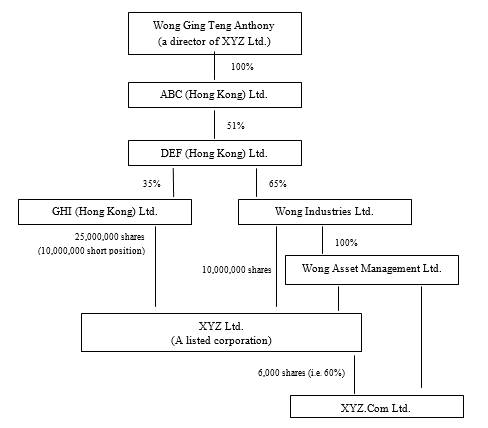

Example of

how to complete Box 36 Assume

that Mr. Wong Ging Teng Anthony is appointed a director of XYZ Ltd. (a listed

corporation). He already owns 100% of

the shares in a private corporation ABC (Hong Kong) Ltd. which owns 51% of

the shares in DEF (Hong Kong) Ltd. which owns 35% of GHI (Hong Kong) Ltd. and

65% of Wong Industries Ltd. Wong Industries Ltd. in turn owns 100% of the shares

in Wong Asset Management Ltd. The group holdings in XYZ Ltd. are as follows: GHI

(Hong Kong) Ltd. owns 25,000,000 shares and has a short position in

10,000,000 shares. Wong Industries Ltd. owns 10,000,000 shares and Wong Asset

Management Ltd. owns 15,000,000 shares. XYZ Ltd.

owns 6,000 shares in a private company, XYZ.Com Ltd. that has an issued share

capital of 10,000 shares i.e. it owns 60% of the issued shares making XYZ.Com

an associated corporation. On 1 April 2002 XYZ Ltd. granted Wong Asset Management

Ltd. an option to acquire from XYZ Ltd. 900 shares or 9% of the shares of

XYZ.Com Ltd. in issue. The option has not yet been exercised. Details of this

option will have been disclosed in Box 34. Group

structure and holdings :

In this example, the entries in Box 36 would be as

follows : 36. Further information in relation to interests of corporations controlled

by directors

Note that

the interests in shares of XYZ Ltd. need not be disclosed in this Form 3B as

the event prompting disclosures is not an Initial Notification. If the event

prompting disclosure was the appointment of Mr. Wong as a director of XYZ

Ltd. this would be an Initial Notification requiring disclosure of all his

interests in shares of the listed corporation of which he is a director, and

interests in any associated corporations. Those interests should be disclosed

separately using 2 forms – Form 3A and Form 3B. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 37 |

If you are interested in shares of

the associated corporation concerned jointly with another person, you are

both taken to be interested in all of the shares held jointly. Details of

that interest must also be taken into account in completing Boxes 31 and 32. If this is an Initial Notification, you must

complete Box 37 if you are interested in shares of the associated corporation

concerned jointly with another person. State the name of the person who owns

the interest in the shares jointly with you, his/her/its address and the

number of shares in which he/she/it is interested. If this is not an Initial Notification, you must

only give details if the shares in which you are interested jointly with

another person were involved in the relevant event. State the name of the

person who owns the interest in the shares jointly with you, his/her/its

address and the number of shares involved in the relevant event in which

he/she/it was interested. The same principles apply to short

positions held jointly. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 38 |

If you are

a trustee of a trust, a beneficiary of a trust, or if you are the “founder”

of a discretionary trust (e.g. you had a discretionary trust set up or you

put assets into it) and can influence how the trustee exercises his

discretion, then you are taken to be interested in all the shares of the

associated corporation in which the trust has an interest (or a short

position). Details of that interest must also be taken into account when

completing Boxes 31 and 32. Ignore an interest in reversion or remainder, an

interest of a bare trustee. If this is

an Initial Notification, you must complete Box 38 if you are interested in

shares of an associated corporation through a trust. You need not state the

name of the Trust which owns the interest in the shares and its address in

columns 1 and 2 if you wish these to remain private. State the description

which best describes your status in relation to the trust either by entering

the Code from Table 5 or selecting

the Code from the menu in column 3. State the number of shares in which the

trust is interested (has a short position) in column 4 (and 5). If this is

not an Initial Notification, you must only give details if the shares in

which you are interested through a trust were involved in the relevant event.

State the name of the Trust which owns the interest in the shares, its

address and the number of shares involved in the relevant event in which the

trust was interested. See Table 5

for Codes of Status in relation to a Trust. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 39 |

Provide any supplementary information, e.g. the

description of the relevant event if you select Code 1113 (any other event),

Code 1213 (any other event), Code 1316 (any other event), Code 1403 (any

other event), Code 1503 (any other event), Code 1702 (Notice filed to remove

outdated information), Code 1710 (Voluntary disclosure) or Code 1711 (Other);

the capacity if you select Code 2501; the category of derivatives if you

select Code 4104 or 4108. The word limit of this Box is 500

characters of text and numbers. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Box 40 |

Tick this box if this Form 3B is a

revision of a previously submitted Form and insert the log/serial number of

the Form which you intend to revise. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Table 1 – Codes of Relevant Events

Please note that :

(1)

It may be necessary to go through two to three levels

of questions before reaching the relevant event and an event code is only

assigned to the last level of question.

Code numbers in brackets are interim level(s) of questions and they are

not event codes. Only the ultimate event

codes will be available for selection.

(2)

The same set of event codes apply to all Forms so some

code numbers are “skipped” because certain events are not relevant to this

Form.

(3)

The term “your interest/short

position” in these event codes refers to your own interest and also includes an

interest of your spouse, your minor child or a corporation that is controlled

by you, that is taken to be your interest by attribution.

(4)

The “shares” are the shares of the associated

corporation of the listed corporation.

|

Code No. (Level 1) |

Code No. (Level 2) |

Code No. (Level 3) |

Description of event (Box 30) |

|

(110) |

|

|

The number of shares in which you are interested has

increased because: |

|

(120) |

|

|

The number of shares in which you are interested has

reduced because: |

|

(130) |

|

|

There has been a change in nature of your interest

in the shares because: |

|

(140) |

|

|

You came to have a short position in the shares or the

number of shares in which you have a short position increased because: |

|

(150) |

|

|

You ceased to have a short position in the shares or

the number of shares in which you have a short position decreased because: |

|

(170) |

|

|

Miscellaneous |

|

|

|

|

|

|

(110) |

|

|

The number of

shares in which you are interested has increased because: |

|

|

1101 |

|

|

|

|

1102 |

|

you were given

the shares |

|

|

(1103) |

|

you became the

holder of, wrote or issued equity derivatives under which (choose one): |

|

|

|

11031 |

you have a right

to take the underlying shares |

|

|

|

11032 |

you are under an

obligation to take the underlying shares |

|

|

|

11033 |

you have a right

to receive from another person an amount if the price of the underlying

shares is above a certain level |

|

|

|

11034 |

you are under an

obligation to pay another person an amount if the price of the underlying

shares is below a certain level |

|

|

|

11035 |

you have any of

the rights or obligations referred to in 11031 to 11034 above embedded in a

contract or instrument |

|

|

1104 |

|

you acquired a

security interest in the shares |

|

|

1105 |

|

you inherited

the shares |

|

|

1106 |

|

you became a

beneficiary under a trust interested in the shares |

|

|

1108 |

|

your spouse

ceased to be a director or chief executive of the listed corporation |

|

|

1109 |

|

you entered into

an agreement for the exchange of an instrument for another instrument in

respect of the same underlying shares |

|

|

1110 |

|

you were placed

the shares as a placee under a top-up placing |

|

|

1111 |

|

new shares were

issued to you after you have reduced your interest in shares by placing them

to placee(s) under a top-up placing |

|

|

1113 |

|

any other event

(you must briefly describe the relevant event in the Supplementary

Information box) |

|

(120) |

|

|

The number of

shares in which you are interested has reduced because: |

|

|

1201 |

|

|

|

|

1202 |

|

you made a gift

of the shares |

|

|

1203 |

|

you delivered

the shares or an amount due under equity derivatives |

|

|

(1204) |

|

expiry or

cancellation without exercise of equity derivatives under which (choose one): |

|

|

|

12041 |

you had a right

to take the underlying shares |

|

|

|

12042 |

you were under

an obligation to take the underlying shares |

|

|

|

12043 |

you had a right

to receive from another person an amount if the price of the underlying

shares was above a certain level |

|

|

|

12044 |

you were under

an obligation to pay another person an amount if the price of the underlying

shares was below a certain level |

|

|

|

12045 |

you had any of

the rights or obligations referred to in 12041 to 12044 above embedded in a

contract or instrument |

|

|

1205 |

|

you ceased to

have a security interest in the shares |

|

|

1206 |

|

you did not take

up, or sold, rights in a rights issue |

|

|

1207 |

|

your spouse

became a director or chief executive of the listed corporation |

|

|

1208 |

|

you entered into

an agreement for the exchange of an instrument for another instrument in

respect of the same underlying shares |

|

|

1209 |

|

you placed the

shares to placee(s) under a top-up placing |

|

|

1210 |

|

new shares were

issued in a top-up placing |

|

|

1213 |

|

any other event

(you must briefly describe the relevant event in the Supplementary

Information box) |

|

(130) |

|

|

There has been a

change in nature of your interest in the shares because: |

|

|

1301 |

|

|

|

|

1302 |

|

you have entered

into an agreement for the sale of shares in which you are interested |

|

|

1303 |

|

you have

exercised rights to the shares under equity derivatives |

|

|

1304 |

|

rights to the

shares under equity derivatives have been exercised against you |

|

|

1305 |

|

you have

provided an interest in the shares as security to a person other than a

qualified lender |

|

|

1306 |

|

an interest in

the shares, that you provided as security to a person other than a qualified

lender, has been released |

|

|

1307 |

|

you have taken

steps to enforce a security interest in the shares, or rights to such shares

held as security, and you are not a qualified lender |

|

|

1308 |

|

steps have been

taken to enforce a security interest in the shares, or rights to such shares

held as security, against you |

|

|

1309 |

|

you are a

beneficiary under a will and the shares have been transferred to you by an

executor |

|

|

1310 |

|

you are a

beneficiary under a trust and the shares have been transferred to you by a

trustee |

|

|

1311 |

|

you have

delivered the shares to a person who had agreed to borrow them |

|

|

1312 |

|

the shares lent

by you have been returned to you |

|

|

1313 |

|

you have lent

the shares under a securities borrowing and lending agreement |

|

|

1314 |

|

you have

recalled the shares under a securities borrowing and lending agreement |

|

|

1315 |

|

you have

declared a trust over shares that you continue to hold |

|

|

1316 |

|

any other event

(you must briefly describe the relevant event in the Supplementary

Information box) |

|

(140) |

|

|

You came to have

a short position in the shares or the number of shares in which you have a

short position increased because: |

|

|

(1401) |

|

you became the holder of, wrote or issued equity derivatives under

which (choose one): |

|

|

|

14011 |

you have a right

to require another person to take delivery of the underlying shares |

|

|

|

14012 |

you are under an

obligation to deliver the underlying shares |

|

|

|

14013 |

you have a right

to receive from another person an amount if the price of the underlying

shares is below a certain level |

|

|

|

14014 |

you are under an

obligation to pay another person an amount if the price of the underlying

shares is above a certain level |

|

|

|

14015 |

you have any of

the rights or obligations referred to in 14011 to 14014 above embedded in a

contract or instrument |

|

|

1402 |

|

you borrowed the

shares under a securities borrowing and lending agreement |

|

|

1403 |

|

any other event

(you must briefly describe the relevant event in the Supplementary

Information box) |

|

(150) |

|

|

You ceased to have

a short position in the shares or the number of shares in which you have a

short position decreased because: |

|

|

(1501) |

|

expiry or

cancellation without exericse of equity derivatives under which (choose one): |

|

|

|

15011 |

you have a right

to require another person to take delivery of the underlying shares |

|

|

|

15012 |

you are under an

obligation to deliver the underlying shares |

|

|

|

15013 |

you have a right

to receive from another person an amount if the price of the underlying

shares is below a certain level |

|

|

|

15014 |

you are under an

obligation to pay another person an amount if the price of the underlying

shares is above a certain level |

|

|

|

15015 |

you have any of

the rights or obligations referred to in 15011 to 15014 above embedded in a

contract or instrument |

|

|

1502 |

|

you returned the

shares borrowed under a securities borrowing and lending agreement |

|

|

1503 |

|

any other event

(you must briefly describe the relevant event in the Supplementary

Information box) |

|

(170) |

|

|

Miscellaneous |

|

|

1701 |

|

On listing of the corporation or a class of shares of the listed

corporation |

|

|

1702 |

|

Notice filed to

remove outdated information (if you select this Code you must state the

outdated information in the Supplementary Information box and identify the

box which contains the updated information) |

|

|

1705 |

|

Notice filed

because you became a director or chief executive of the listed corporation |

|

|

1706 |

|

Notice filed

because you ceased to be a director or chief executive of the listed

corporation |

|

|

1707 |

|

Notice filed because

the corporation became an associated corporation of the listed corporation |

|

|

1708 |

|

Notice filed

because the corporation ceased to be an associated corporation of the listed

corporation |

|

|

1709 |

|

Notice filed

because the corporation changed its name |

|

|

1710 |

|

Voluntary

disclosure (you must briefly describe the relevant event in the Supplementary

Information box) |

|

|

1711 |

|

Other (you must

briefly describe the relevant event in the Supplementary Information box) |

Table 2 – Codes of Capacity

Please note the

same set of capacity code numbers apply to all Forms so some code numbers are

“skipped” because certain capacities are not relevant to this Form.

|

Code No. |

Description of

the capacity in which you held the interest or short position in shares that

is acquired, disposed of or changed

(Boxes 30 and 33) |

|

|

Common capacities |

|

2101 |

Beneficial owner |

|

2103 |

Interests held jointly with another person |

|

2104 |

Agent |

|

2105 |

Underwriter |

|

2106 |

Person having a security interest in shares |

|

|

Interests by attribution |

|

2201 |

Interest of corporation controlled by you |

|

2202 |

Interest of your spouse |

|

2203 |

Interest of your child under 18 years of age |

|

|

Trusts and similar interests |

|

2301 |

Trustee |

|

2302 |

Custodian (other than an exempt custodian interest) |

|

2303 |

Depositary |

|

2304 |

Executor or administrator |

|

2305 |

Beneficiary of a trust (other than a discretionary interest) |

|

2306 |

Nominee for another person (other than a bare trustee) |

|

2307 |

Founder of a discretionary trust who can influence how the trustee exercises

his discretion |

|

|

Miscellaneous |

|

2501 |

Other (you must describe the capacity in the Supplementary Information

box) |

Table 3 – Codes of Nature of Consideration

|

Code No. |

Description of consideration for off-exchange

transactions (Box 30) |

|

3101 |

Cash |

|

3102 |

Assets other than cash |

|

3103 |

Surrender of rights to shares/debentures |

|

3104 |

Services |

Table 4 – Codes of Category of Derivatives

|

Code No. |

Common categories of derivatives (Box 34) |

|

|

Listed derivatives |

|

4101 |

Physically settled |

|

4102 |

Cash settled |

|

4103 |

Convertible instruments |

|

4104 |

Other (you must describe the category of derivatives in the

Supplementary Information box) |

|

|

Unlisted derivatives |

|

4105 |

Physically settled |

|

4106 |

Cash settled |

|

4107 |

Convertible instruments |

|

4108 |

Other (you must describe the category of derivatives in the

Supplementary Information box) |

Table 5 – Codes of Status in relation to a Trust

|

Code No. |

Status in

relation to a trust (Box 38) |

|

5101 |

Trustee of a trust |

|

5102 |

Beneficiary of a trust (other than a discretionary interest) |

|

5103 |

Founder of a discretionary trust who can influence how the trustee

exercises his discretion |